The Year in Review: India Gets Closer to Safe Money Gaming

29 Dec 2023

On the 23rd of December, one year ago, the Union Ministry of Electronics and IT (MeitY) was appointed as the nodal ministry for online gaming in India and assumed responsibility over the sector to “draft a legislative framework to regulate” it.

A year before that, in December 2021, a member of the Rajya Sabha, Sushil Kumar Modi, had raised the issue of gaming addictions, the lack of proper taxation, and other gaming-related problems.

Senior BJP leader Modi had also pointed out the failure of many states like Karnataka and Tamil Nadu to find a solution in the form of blanket bans on online games for stakes.

As a result, 2023, which is at its end now, was a whirlwind of developments on the legal and taxation fronts for online gaming with money.

Clarity In Legal Space Is Emerging Gradually

Online gaming used to be a terra incognita for nearly all of India’s national and state legal system for many years, but with the start of 2023, new regulatory winds began to lift the fog.

The appointment of MeitY as the nodal ministry for these activities and the subsequent adoption of gaming-related amendments to the IT Rules strived to outline India’s emerging legal framework for the sector.

“Earlier, since the nodal ministry was not defined, nobody was ready to take the responsibility [for online gaming]. That has now been clarified with the amendments,” gaming and tech lawyer Jay Satya commented in December 2022.

The amendments to the IT Rules proposed by MeitY in January this year and notified in April after extensive consultations with stakeholders finally clarified whether providers of online games should be treated as publishers or intermediaries, settling for the latter.

At the same time, the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Amendment Rules, 2023 added more clarity to the picture by introducing several key definitions in legal space for the first time, such as “online game” and “permissible online real money game.”

Attempt to Balance Regulation and Self-Regulation

As per MeitY’s initial vision, central government regulations would only provide the general framework, and newly established Self-Regulatory Organizations or Bodies (SROs or SRBs) would refine the details and determine which online money games are “permissible.”

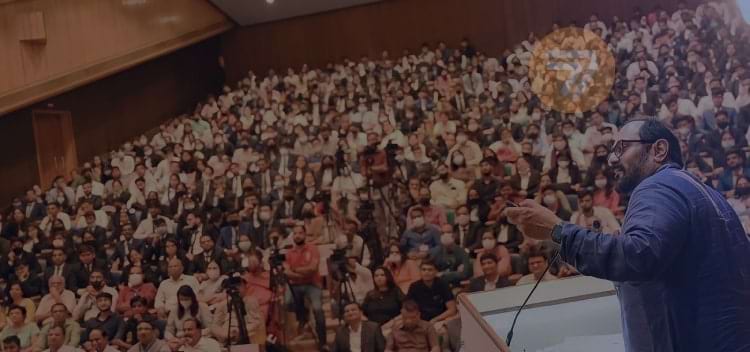

Minister of State for IT Rajeev Chandrasekhar explained the logic behind the Central Government’s approach to gaming regulation in an interview:

“Online gaming, like many parts of the digital economy, is driven by innovation by the young, and we don’t want the government to regulate what young Indians do. We are open to having industry and other stakeholders create a credible institution that will then regulate that space,” he told the reporters.

All of India’s major Industry bodies were quick to propose four SROs, announced to be fully compliant with MeitY ‘s requirements for unbiased, non-industry-dominated bodies with broad representation capable of fostering responsible gaming and user safety.

Everything seemed ready for the actual work on regulating the sector to start. Still, MeitY never approved the proposed SROs, and they never commenced functioning, as the Center realized the matter had been more complicated than anticipated.

Clarity on the Other Side of the Puzzle: Taxes

In the meantime. The question of how to tax online games when played with stakes also started revealing its silhouette in clearer form. Which was more dreadful than industry stakeholders had thought possible.

The direct taxes front has been relatively stable for years. Income tax on winnings from money games has been fixed at 30% plus surcharges. However, 2023 saw some changes in the mechanics of TDS calculations.

However, indirect taxes turned into a full-fledged nightmare for the government and the industry.

A Group of Ministers (GoM) was formed. It was tasked to solve the complexities of GST levy on online games, casinos, horse races and lottery. It took the GoM three years to come up with its final recommendations. Only to pass on the matter unsolved to be decided on by the GST Council.

The 50th GST Council Meeting was held on the 11th of July. The GST Council did provide a solution. But it was quickly forced to clarify it further at an urgently convened 51st Meeting. The 51st Meeting was held on the 2nd of August.

The Question of Online Gaming Wagers Valuations

The amendments to GST legislation adopted by Parliament following the GST Council recommendations introduced the entry-level rule. This rule exempts re-betting of winnings from levy. It served to clarify the government’s stance. Specifically, on how wagers on online money games should be evaluated for the purposes of GST.

Indian online gaming companies had been paying 18% GST over their trade margin or GGR (Gross Gaming Revenue) since 2017. Claiming that their product is skill-based and hence exempt from the high tax rates applied for gambling.

The Union Central Board of Indirect Taxes and Customs (CBIC) and its enforcement arm – the Directorate General of GST Intelligence (DGGI), have been maintaining the position that any wagers on an online game should be levied with GST at 28% over the full bet value.

The conflict between the two opposing views on GST valuation has been brewing since GST was introduced in July 2017. The expiry of 5-year statutes of limitations is approaching. GST Enforcement offices started sending show cause notices. These notices were sent to gaming companies alleging tax evasion to a total volume of ₹1,12,332 crore.

The clash has now reached the Supreme Court. And 2024 will begin with a hearing scheduled for the 8th of January. Where the Center will have to defend its stance against the batched challenges of practically the whole industry.

In the meantime, global consultancy EY adjusted its forecast for the development of India’s online gaming sector, lowering expectations for future growth from a CAGR (compound annual growth rate) from 28% (FY20-FY23) to 15% (FY24-FY28) due to the hiked GST burden.

A Slow Down of Regulatory Momentum

The Union Government took notice that matters became more complicated than expected. They realised that the emerging legal framework might lack the strength to control offshore and illegal online gambling. It also might not effectively bring these activities under taxation and regulation. As a result the government decided to step back and take time to reconsider.

Top-level officials formed a new GoM. The GoM included the Ministers of Home, IT, Finance and Information & Broadcasting. It was tasked to re-examine the situation and propose solutions. This, instead of approving the four proposed SROs and allowing them to start functioning.

India might be a few giant steps closer to achieving a stable and healthy online gaming environment. An environment that is safe for consumers and beneficial for government and business.

However, this final goal might not be as near yet as we would wish. And a number of risks still lie ahead. Will India succeed in this complex task? Will the new regime be effective or rather toothless? Or will the government torpedo the prospect of safe gaming for everyone by overregulation and over-taxation?