Key Findings of the Report

- All casino winnings and other gambling income – regardless of origin, online or offline – exceeding ₹10,000 need to be reported in the annual tax form.

- The Income Tax Act of 1961 places all real-money games (RMG) under the same category – “lottery, crossword puzzle[,] race, including horse race or card game or any [other form of] gambling or betting whatsoever” above the untaxable minimum – are subject to a flat rate of 31.2%.

- Most legal gambling venues tend to withdraw 30% TDS (Tax Deducted at Source) on winnings over ₹10,000. On the contrary, the most popular offshore (online) casinos rarely deduct your taxes. Meaning that all players have to declare them personally.

- Gambling laws in India often differ from state to state. However, income tax is imposed by the Centre and applies to all Indian residents.

The Big Picture: On Indian Gambling Taxation

We all know India moves somewhat slowly on non-priority legislation and administrative issues. However, the desi market evolves much quicker. And Indian tech and gaming companies have already contributed immensely to the technological and economic growth of the whole Asian continent.

Our Indian gambling research paper on tax regulations is based on top-level legal sources and official government publications. These start, inevitably, with the Public Gaming Act of 1867. Which is rather obsolete but still serves formally as the foundation of gambling levy requirements.

Next, the Income Tax Act and its Section 194B define the categories and tax brackets that are liable to income levy. Further, Section 115BB was introduced as an Amendment to the Finance Act of 1986.

Last but not least, the Prevention of Money Laundering Act (2002, PMLA) clearly states that “entities incorporated or established abroad should not be considered reporting entities.”

These legislative cornerstones set up a legal framework clearly based on the actual location of both gaming companies and players.

- Gamers need to declare all real-money income on their annual tax form – true for both residents and non-residents – if the income comes from India;

- Foreign-based gaming platforms are not required to pay taxes in India; this is usually the case for online casinos and other gaming sites;

- Everyone else has to pay the flat 30% levy above the non-taxable Rs 10,000 annual minimum.

Are Taxes Central or State? Are There Any Tax Differences by State?

Another major concern of online casino players is whether all gambling winnings are traced and taxed. The question is not only who tracks these money flows but how far our responsibilities go in reporting our actual gambling earnings.

The Income Tax Act is clear on this one as well. All income from both legal and illegal activities is subject to taxation. Most states do not have explicit regulations on online gaming platforms. So these may not be licensed in India and still provide players with jackpot wins that have to be taxed.

The four laws we cited above make no distinction between states, taxable thresholds, or reporting mechanisms. Some state-specific taxes exist. But they are listed in local betting and gambling acts and regard gaming operators rather than players.

Some regional examples include the Andhra Pradesh Horse Racing and Betting Tax Regulation 1358F of 1949 (valid also for the Telangana Area) and the Delhi Entertainments and Betting Tax Act of 1996.

Personal taxes depend on residency and source, as we noted above. The Income Tax Department is administered by the Central Board of Direct Taxation (CBDT). Both parts of the Ministry of Finance’s Revenue Department. Income tax is, in fact, a Central matter and remains the government’s most important revenue source.

Any so-called “grey areas” are related to the legal status of online gambling on a state-by-state basis. Income taxation does not differ by gambling type; this much is clear. Some of the most popular e-gaming platforms might end up beyond the reach of India’s taxation authorities when they are based abroad or online. Players, however, need to be honest and transparent about their winnings.

Direct Surcharges on Income Taxation

So does it end with the said 30% for all Indians who have won real money online? Well, not really, because the “flat rate” has been updated over the years and deserves an asterisk.

We rarely see people earning their living regularly through real-money gaming. Especially in the highest income slabs (Rs 2 Cr – Rs 5 Cr and above). However, there are tax conditions for gross gambling earnings above certain thresholds:

- Gambling income above Rs 50 Lakhs (~EUR 61,900 at current exchange rates) attracts a surcharge of 10%;

- For gaming income in excess of Rs 1 Crore (EUR 123,800). The surcharge becomes 15% on top of the normal tax rate.

Such sums are, of course, rare and are mostly applicable to lottery winners. And most online casinos tend to require players to withdraw big jackpot wins in several separate transactions. This, in reality, makes only one surcharge universally applicable. And a steady addition to the flat-rate income tax on gambling income:

- A Health and Education Cess that is set at 4% and does not depend on income brackets. The surcharge finances national priority projects in health and education and is payable by all persons liable to income tax.

Therefore, the actual tax rate for casino and gambling earnings in India is 30% + 0.04×30% = 31.2%.

For winnings that are big enough to attract a surcharge, Cess is calculated over the tax and surcharge combined. For example, the tax burden calculation for a winning between Rs 50 lakhs and Rs 1 crore looks like the following: 30% + 0.10×30% + 0.04x(30% + 0.10×30%) = 34.32%.

Update: Income Tax Changes after the 1st of April, 2023

The Finance Bill, 2023, introduced some changes to Indian income tax legislation. Including a differentiated treatment of online games from gambling and betting for the purposes of TDS collection.

For gambling and betting, the new provisions clarify that the Rs 10,000 non-taxable threshold would be applicable on an annual basis, i.e., splitting of winnings over several small withdrawals would not make a difference.

Are There Any Indirect Taxes on Gambling Income?

The indirect tax on all products and services – namely, the Goods and Services Tax (GST) has often been in financial news headlines since its introduction in 2017. Within the GST Act, a specifically defined category of entertainment events and services lists casinos. Race courses, and related services, all taxable at the rate of 28%.

The simple reason why players should not worry about this tax is because it is the responsibility of “registered suppliers” of the goods and services to pay the actual GST levy. An equivalent of what Westerners call Value Added Tax (VAT), it is already included in the final buy-in price for gaming or other entertainment.

Inevitably, this affects lottery ticket prices, in-app purchases, gaming subscriptions, and any other game-related spending. In turn, this decreases player return, albeit only statistically. But at least there are no further calculations and tax declarations to be made by consumers.

The fact of the matter is that GST has been a major obstacle for desi gaming platforms, regardless of their monetization model. RMG operators are especially concerned about the disadvantage this creates against offshore websites and foreign mobile apps (who pay neither GST nor local income tax). However, the Centre intends to tax all paid gaming on face value with 28% GST in addition to direct levies on company revenues.

Update: Changes in GST Regime after the 1st of October, 2023

Based on recommendations from the GST Council, Parliament adopted changes to Indian GST legislation. Effectively removing differences in GST treatment over online money gaming, gambling, and betting from the 1st of October 2023.

As per the new indirect tax regime, online games involving money. Regardless of any skill-based nature, attract 28% over the full face value of entry deposits. Previously, Indian online skill gaming companies used to charge 18% on their rake fees or Gross Gaming Revenue only.

These businesses are now arguing with GST authorities whether this practice was tax compliant with egregious tax evasion allegations to the time of ₹1 lakh crore being at stake at various courts. While for their clients, the new heavier levy is still to be felt with larger skill gaming companies opting to absorb the impact for the time being.

From the point of view of gamblers frequenting brick-and-mortar casinos in Goa and Sikkim. The amendments brought relief to the GST levy. While previously, 28% GST was charged over the full value of all bets. Now the levy is due only on the initial purchase of chips. And not on any subsequent bets from winnings.

Concerning online casinos operating from offshore registrations. The 2023 GST amendments introduced an obligation to get a “simplified registration” for GST levy if they plan to cater to customers residing in India.

Where Can I Find Information about My Tax Situation?

When the Covid pandemic changed physical space and online services drastically, the CBDT was quick to extend the deadline for filing income tax returns (ITRs) to December 31. This has not been reverted yet and gives more time to submit one’s forms. However, players must check back often and update themselves about the latest tax filing deadlines.

- All correctly reported winnings for betting and gaming transactions based in India need to be linked to the Aadhaar/PAN Card of both the operator and the player;

- Although betting and gambling income might be seen as a form of “investment” by some users (given some deep-rooted cultural implications surrounding gambling). Government officials have been clear that gaming losses are not tax-deductible (Section 80C of the ITC), even for skill-based games that are constitutionally protected;

- The non-taxable minimum should always be observed by casino and RMG operators. Above Rs 10,000, one may expect to see their winnings cut by 30% (or rather 31.2%) before withdrawing funds.

However, that is not always the case with online operators outside Indian jurisdiction, as they are not subjected to local taxation laws and never hike prices through GST.

Tax Situation

Some online casinos adhere to the industry-wide practice of deducting the player tax at source (TDS of 30% or 31.2% when applicable), although they are not a clear majority. In that case, gamers need to keep their receipts or digital records from the sums paid out to them, including a clear indication that income tax has already been deducted.

Some online casinos advertise the withdrawal of “full-amount” gambling winnings as a market advantage. When an RMG platform pays out these sums entirely, they place the responsibility on gamers to follow through and declare such winnings according to Section 115BB annual tax return rules.

A couple of additional legal caveats:

- The Black Money and Imposition of Tax Act of 2015 deals with “Undisclosed Foreign Income and Assets.” The CBDT has already issued further “clarifications on tax compliance” in 2017. Put simply, those who are blessed enough to win online should also be honest enough to declare the income and avoid legal disputes with the tax authorities;

- Another positive twist: electronic transfers under Rs 50,000 (roughly EUR 620) can be eligible to be considered a gift. And therefore, may also be non-taxable. Withdrawals above that amount are seen as “income from other sources” or “profits and gains from business or profession” and need to be reported.

Will Changes in Gambling Regulation Affect My Taxes?

The outdated Indian legal system fails to cover the complexity of today’s dynamic RMG market. Particularly with online services and global competition in mind. Recent economic setbacks make it even more imperative for Union policymakers to overhaul the gaming regulation and keep up with the changing times.

What may be considered out-of-the-box thinking for some Indian States is already the norm in most mature gaming markets around the World. Strict and well-structured regulation can allow the public treasury to attract substantial tax revenues from the growing gaming industry. While the local economy will retain employment and market benefits.

A few years ago, the Law Commission of India had already urged the Parliament to enact a model law for betting and gambling. Including an indication of taxation issues and positive spillover effects. States would only have to adapt the framework to their local gambling rules and regulations. However, there has only been limited legislative initiative so far on both state (Meghalaya in 2021) and national level (in the Lok Sabha in mid-2022).

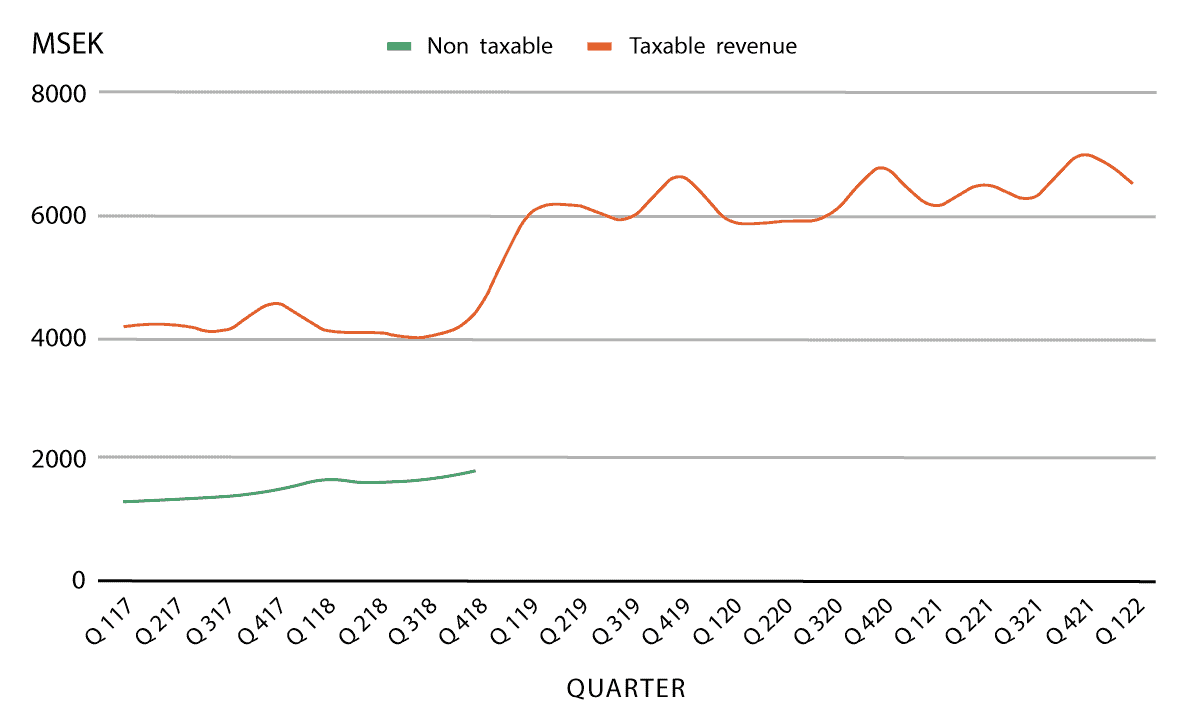

Revenues

The change would be felt within the first year, our experts have found out. Regulating gambling generates remarkable revenues. And the untapped potential of licensed online casinos in India holds immense prospects for the exchequer.

Sweden, one of the leading European democracies, allowed only state-run betting, lottery, and horse racing for decades. When it finally regulated the gambling market in 2019. A demanding licensing regime was installed as a condition for operating in the country.

The regulation forced foreign RMG platforms to obtain a local registration. Observe Sweden’s gaming rules and pay taxes on profits made on players located in the country.

In any case, this never means that consumers have to pay more taxes or that online gaming will cost more. Offshore operators, however, will need to get a proper license. Contribute to the local economy and be responsible for all their actions on Indian soil.

Takeaways for Online Gambling Winners

Despite the fragmented legal framework on gaming regulation and taxation, players that win real money online need to observe a few basic rules.

- Avoid double taxation: verify if you have been taxed at the source. Online transactions are more secure, help keep proof of your withdrawals and simplify tax reporting.

- Play responsibly – also means pay your taxes! Where online gambling is not expressly prohibited, it is up to players to use legitimate channels and pay their dues.

- Trust only reputable casino operators. They either take care of your taxes for you or provide sufficient transparency so that players get their full winnings.